The Future of Money

In today’s rapidly evolving world, the concept of money is undergoing a significant transformation. With the rise of digital currencies, contactless payments, and blockchain technology, the future of money is a topic of great interest and speculation. As we navigate this new landscape, it is crucial to explore the potential implications and possibilities that lie ahead.

The Evolution of Currency

Throughout history, the form of money has evolved from bartering goods to using precious metals as a medium of exchange. In recent decades, we have witnessed the transition from physical cash to digital transactions, facilitated by credit cards, online banking, and mobile payment apps. The emergence of cryptocurrencies like Bitcoin has further disrupted traditional financial systems, offering a decentralized and secure alternative to fiat currencies.

The Rise of Digital Currencies

Digital currencies, such as Bitcoin, Ethereum, and Litecoin, have gained popularity as more people embrace the concept of decentralized finance. These cryptocurrencies operate on blockchain technology, a distributed ledger that ensures transparency and security in transactions. The appeal of digital currencies lies in their ability to bypass traditional banking systems, offering users greater autonomy and privacy in their financial transactions.

The Impact of Contactless Payments

Contactless payments have become increasingly prevalent in today’s society, with consumers opting for the convenience and speed of tapping their cards or smartphones to make purchases. This shift towards contactless payments has been accelerated by the global pandemic, which highlighted the importance of minimizing physical contact in everyday transactions. As more businesses adopt contactless payment options, the use of cash is expected to decline further in the coming years.

The Role of Blockchain Technology

Blockchain technology, the underlying technology behind cryptocurrencies, has the potential to revolutionize various industries beyond finance. Its decentralized and tamper-proof nature makes it ideal for securing sensitive data, verifying transactions, and enabling smart contracts. In the future, blockchain technology could be used to streamline supply chains, enhance voting systems, and digitize assets like real estate and intellectual property.

The Future of Banking

Traditional banking institutions are facing increasing competition from fintech companies and decentralized finance platforms that offer innovative solutions for managing and investing money. As more people turn to digital banking services and peer-to-peer lending platforms, the role of traditional banks in the financial ecosystem may evolve. Banks are likely to adapt by incorporating blockchain technology, artificial intelligence, and other cutting-edge technologies to stay relevant in a rapidly changing landscape.

Challenges and Opportunities

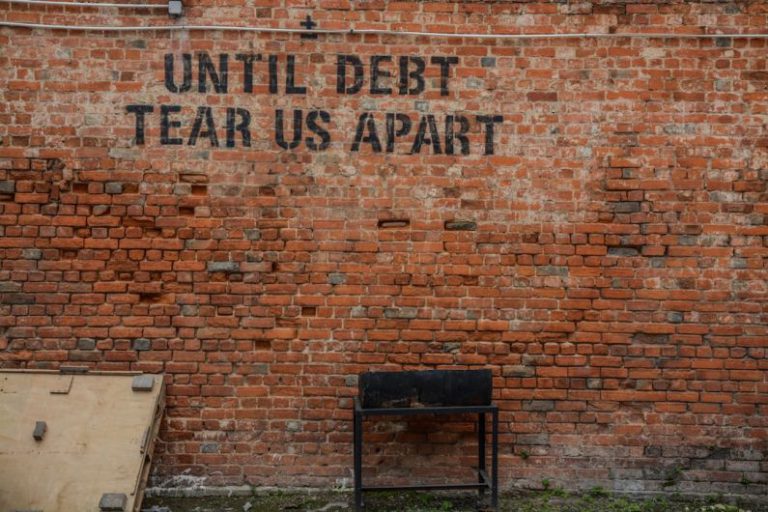

While the future of money holds great promise, it also presents challenges that must be addressed. The regulatory landscape surrounding digital currencies is still evolving, raising concerns about consumer protection, money laundering, and tax evasion. Additionally, the growing wealth inequality and financial exclusion in society underscore the need for inclusive and sustainable financial systems that benefit all individuals.

The Path Forward

To navigate the complex terrain of the future of money, collaboration between governments, financial institutions, technology companies, and regulators will be essential. By embracing innovation, fostering financial literacy, and promoting transparency, we can harness the potential of digital currencies and blockchain technology to create a more equitable and efficient financial system.

In conclusion, the future of money is a dynamic and multifaceted landscape that offers both challenges and opportunities for individuals, businesses, and societies at large. By staying informed, adaptable, and forward-thinking, we can shape a future where money is more than just a medium of exchange—it is a catalyst for positive change and economic empowerment.