Creating a Budget That Works

Budgeting is a crucial aspect of financial management that often gets overlooked or underestimated. Many individuals find it challenging to stick to a budget due to various reasons such as lack of discipline, unforeseen expenses, or simply not knowing where to start. However, creating a budget that works for you is not as complex as it may seem. With some careful planning and dedication, you can take control of your finances and achieve your financial goals.

Understanding Your Income and Expenses

The first step in creating a budget that works is to understand your income and expenses. Start by listing all your sources of income, including your salary, bonuses, rental income, or any other money you receive regularly. Next, make a detailed list of all your expenses, such as rent or mortgage, utilities, groceries, transportation, entertainment, and any other regular payments you make. Be sure to include both fixed expenses, like rent, which stay the same each month, and variable expenses, like groceries, which may fluctuate.

Setting Financial Goals

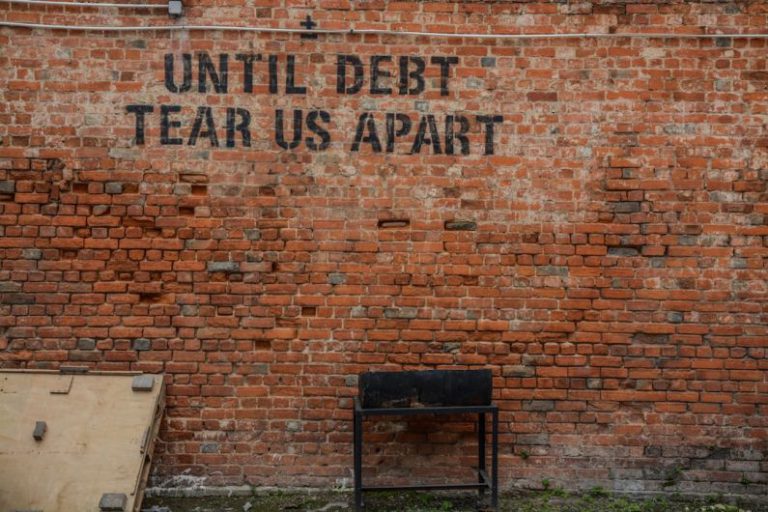

Setting specific financial goals is essential when creating a budget that works. Whether your goal is to save for a vacation, pay off debt, or build an emergency fund, having a clear objective in mind will help you stay motivated and focused. Break down your goals into smaller, achievable milestones, and set a timeline for when you want to achieve them. This will make it easier to track your progress and make necessary adjustments to your budget along the way.

Allocating Your Income

Once you have a clear picture of your income and expenses and have set your financial goals, it’s time to allocate your income effectively. Start by prioritizing your essential expenses, such as rent, utilities, and groceries, to ensure that your basic needs are met. Then, allocate a portion of your income towards your financial goals, whether it’s saving for a down payment on a house or paying off credit card debt. Finally, set aside some money for discretionary spending, such as dining out or entertainment, to allow yourself some room for enjoyment without overspending.

Tracking Your Spending

One of the most critical aspects of creating a budget that works is tracking your spending. Keep a close eye on your expenses and compare them to your budget regularly to ensure that you are staying on track. There are many tools and apps available that can help you track your spending automatically and provide insights into your financial habits. Review your budget monthly and make adjustments as needed to accommodate any changes in your income or expenses.

Building an Emergency Fund

Building an emergency fund is a vital component of a successful budget. Having a financial cushion to cover unexpected expenses, such as medical bills or car repairs, can help you avoid going into debt and stay on track with your financial goals. Aim to save at least three to six months’ worth of living expenses in your emergency fund to provide you with peace of mind and financial security in case of any unforeseen circumstances.

Avoiding Impulse Purchases

Impulse purchases can quickly derail your budgeting efforts and prevent you from reaching your financial goals. Before making a purchase, especially a significant one, take some time to consider whether it aligns with your budget and financial priorities. If you find yourself tempted to make an impulse buy, step back, and give yourself a cooling-off period to reassess whether it’s a necessary purchase or simply a want. By being mindful of your spending habits and avoiding impulse purchases, you can stay on track with your budget and make progress towards your financial goals.

Reassessing Your Budget Regularly

As your financial situation and priorities change, it’s essential to reassess your budget regularly and make necessary adjustments. Life events such as a job change, moving to a new city, or starting a family can impact your income and expenses, requiring you to modify your budget accordingly. Take the time to review your budget at least once a month and make any necessary changes to ensure that it continues to align with your financial goals and priorities.

In Conclusion

Creating a budget that works requires careful planning, discipline, and a clear understanding of your financial situation and goals. By following these steps and staying committed to your budgeting efforts, you can take control of your finances, reduce financial stress, and achieve your financial aspirations. Remember, a budget is not meant to restrict you but to empower you to make informed financial decisions and live a more financially secure life. Start today and take the first steps towards creating a budget that works for you.