Financial Planning for Families

Managing finances can be a daunting task, especially when you have a family to consider. From daily expenses to saving for the future, it’s crucial to have a solid financial plan in place to ensure the well-being and stability of your loved ones. In this article, we will discuss the importance of financial planning for families and provide practical tips to help you secure a prosperous future for you and your family.

Understanding Your Financial Situation

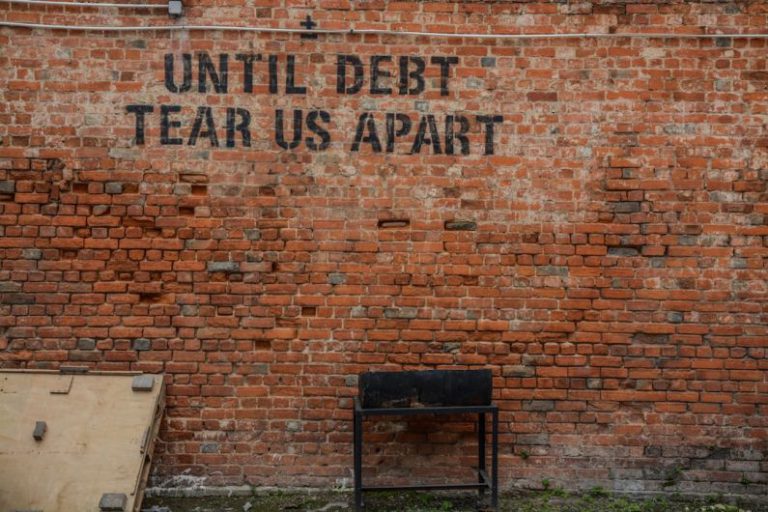

Before you can create a financial plan, it’s essential to have a clear understanding of your current financial situation. Take the time to assess your income, expenses, debts, and savings. Understanding where your money is coming from and where it is going will help you make informed decisions about your finances.

Setting Financial Goals

Once you have a clear picture of your financial situation, the next step is to set specific financial goals for your family. Whether it’s saving for your children’s education, buying a house, or planning for retirement, having clear goals will give you direction and motivation to stick to your financial plan. Make sure your goals are realistic and achievable within a specific timeframe.

Creating a Budget

One of the most critical aspects of financial planning for families is creating a budget. A budget helps you track your income and expenses, allowing you to see where you can cut costs and save more money. Start by listing all your sources of income and fixed expenses, such as rent or mortgage, utilities, and insurance. Then, allocate a portion of your income to savings and discretionary expenses, such as entertainment and dining out.

Emergency Fund

Building an emergency fund is essential for any family’s financial security. An emergency fund can help you cover unexpected expenses, such as medical bills or car repairs, without having to dip into your savings or go into debt. Aim to save at least three to six months’ worth of living expenses in your emergency fund to ensure you are prepared for any unforeseen circumstances.

Insurance Coverage

Insurance is a crucial component of financial planning for families. Make sure you have adequate health insurance, life insurance, disability insurance, and homeowner’s or renter’s insurance to protect your family against unexpected events. Review your insurance coverage regularly to ensure it meets your family’s needs and make adjustments as necessary.

Saving for the Future

In addition to building an emergency fund, it’s essential to save for long-term goals, such as retirement and your children’s education. Consider opening a retirement account, such as a 401(k) or IRA, to save for retirement and take advantage of employer matching contributions if available. For your children’s education, you can set up a 529 college savings plan or a custodial account to help cover the cost of their education.

Investing Wisely

Investing can be a valuable tool for building wealth and achieving your financial goals. Consider working with a financial advisor to develop an investment strategy that aligns with your risk tolerance and financial goals. Diversify your investments across different asset classes to minimize risk and maximize returns over the long term.

Review and Adjust Your Financial Plan

Financial planning is an ongoing process that requires regular review and adjustments. Take the time to review your financial plan regularly to ensure you are on track to meet your goals. Make adjustments as needed based on changes in your financial situation, goals, or market conditions.

Securing Your Family’s Financial Future

By following these tips and taking a proactive approach to financial planning, you can secure a prosperous future for you and your family. Remember that financial planning is a journey, and it’s essential to stay committed to your goals and make informed decisions along the way. With careful planning and discipline, you can build a solid financial foundation that will benefit your family for years to come.