Planning for Retirement

Retirement might seem like a distant dream when you’re in the midst of a busy career and juggling multiple responsibilities. However, preparing for retirement is a crucial aspect of financial planning that should not be overlooked. Just like any other goal, retirement requires careful planning and foresight to ensure a comfortable and secure future. Here are some essential considerations to keep in mind when planning for retirement.

Understanding Your Retirement Goals

Before diving into the nitty-gritty details of retirement planning, take some time to reflect on your retirement goals. What kind of lifestyle do you envision for yourself during your retirement years? Do you plan to travel extensively, pursue hobbies, or simply enjoy a peaceful life at home? Understanding your retirement goals will help you determine how much money you will need to support your desired lifestyle.

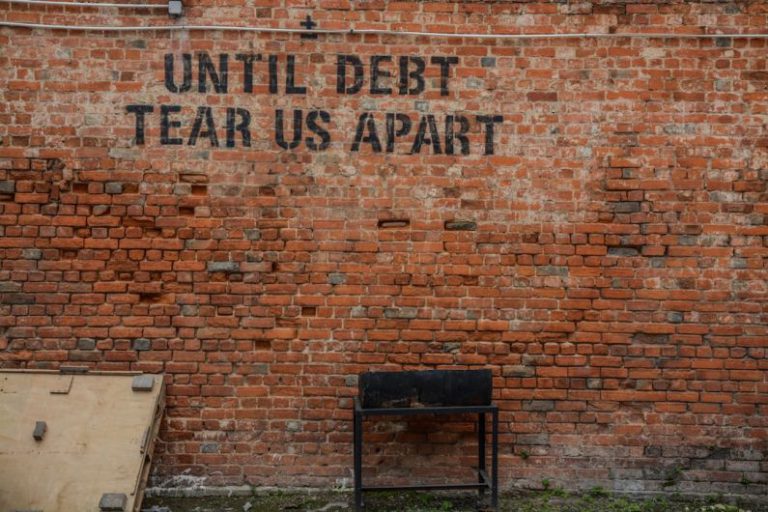

Assessing Your Current Financial Situation

Once you have a clear picture of your retirement goals, the next step is to assess your current financial situation. Calculate your current assets, including savings, investments, and any retirement accounts you may have. Take stock of your debts and liabilities as well. Understanding your current financial position will help you determine how much you need to save for retirement and what steps you need to take to reach your goals.

Creating a Retirement Savings Plan

Based on your retirement goals and current financial situation, create a detailed retirement savings plan. Determine how much you need to save each month to reach your retirement savings target. Consider leveraging retirement accounts like 401(k)s, IRAs, or employer-sponsored plans to maximize your savings potential. Automate your savings by setting up regular contributions to your retirement accounts to ensure consistency and discipline in your savings strategy.

Investing for Retirement

Investing is a crucial component of retirement planning as it can help grow your savings over time. Consider diversifying your investment portfolio to mitigate risk and maximize returns. Consult with a financial advisor to develop an investment strategy that aligns with your risk tolerance and retirement goals. Regularly review and adjust your investment portfolio as needed to ensure that it remains in line with your retirement objectives.

Monitoring and Adjusting Your Retirement Plan

Retirement planning is not a one-time activity but rather an ongoing process that requires regular monitoring and adjustments. Keep track of your progress towards your retirement goals and make necessary changes to your savings and investment strategy as your circumstances evolve. Life events such as marriage, children, job changes, or health issues may require you to modify your retirement plan accordingly. Stay proactive and flexible in managing your retirement plan to stay on track towards a secure retirement.

Social Security and Other Retirement Benefits

In addition to personal savings and investments, consider the role of Social Security and other retirement benefits in your overall retirement plan. Understand how Social Security benefits are calculated and when you will be eligible to start receiving them. Factor in other retirement benefits such as pensions, annuities, or healthcare coverage provided by your employer into your retirement planning strategy. Maximize these benefits to supplement your retirement income and enhance your financial security during retirement.

Estate Planning and Legacy Considerations

Estate planning is an often overlooked aspect of retirement planning but is essential for ensuring that your assets are distributed according to your wishes after your passing. Create a will or trust to outline how you want your assets to be distributed and designate beneficiaries for your retirement accounts and insurance policies. Consider establishing a power of attorney and healthcare directives to manage your affairs in the event of incapacity. Review and update your estate plan regularly to reflect any changes in your financial situation or family circumstances.

Embracing Retirement with Confidence

Retirement is a significant life transition that can be both exciting and daunting. By taking proactive steps to plan for retirement, you can approach this new phase of life with confidence and peace of mind. Start early, stay disciplined, and seek professional guidance when needed to build a solid retirement plan that aligns with your goals and aspirations. With careful planning and prudent decision-making, you can enjoy a fulfilling and financially secure retirement that rewards you for a lifetime of hard work and dedication.