Wealth Building for Millennials

Building wealth as a millennial may seem like an intimidating task, especially in a world full of financial challenges and uncertainties. However, with the right mindset, strategies, and discipline, millennials can take control of their financial futures and work towards achieving their wealth-building goals. In this article, we will explore practical tips and advice tailored to help millennials navigate the path to financial success.

Set Clear Financial Goals

Setting clear financial goals is the first step towards building wealth effectively. As a millennial, take the time to define what wealth means to you personally. Whether it’s buying a home, starting a business, or achieving financial independence, having specific, measurable, achievable, relevant, and time-bound (SMART) goals will give you a clear direction and motivation to stay on track.

Embrace a Savings Mindset

Saving money is a fundamental aspect of wealth building. Start by creating a budget that outlines your income, expenses, and savings goals. Aim to save a portion of your income regularly, even if it’s a small amount. Consider automating your savings by setting up automatic transfers to a high-yield savings account or investment account. This way, you can ensure that you consistently save and grow your wealth over time.

Invest Wisely

Investing is a powerful tool for wealth building, and millennials have a significant advantage with time on their side. Consider investing in a diversified portfolio of assets such as stocks, bonds, real estate, and mutual funds. Research different investment options and choose ones that align with your risk tolerance, financial goals, and time horizon. Remember to regularly review and rebalance your investment portfolio to ensure it remains in line with your objectives.

Focus on Income Growth

Increasing your income can accelerate your wealth-building journey. Look for opportunities to boost your earnings, whether through advancing in your career, starting a side hustle, or investing in your skills and education. Consider negotiating for higher pay, seeking promotions, or exploring new job opportunities that offer better compensation. By actively working towards increasing your income, you can create more resources for saving, investing, and building wealth.

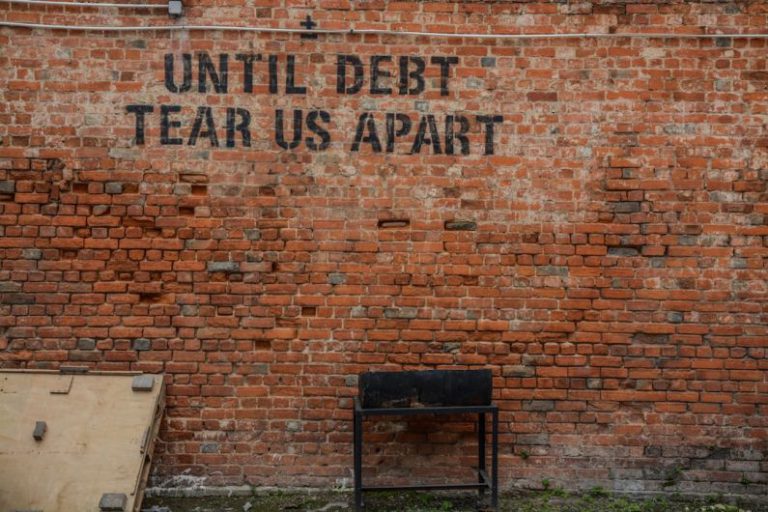

Avoid Debt and Manage Credit Wisely

Debt can be a significant obstacle to wealth building if not managed properly. Avoid accumulating high-interest debt, such as credit card debt, and focus on paying off existing debts as quickly as possible. Use credit responsibly by making timely payments, keeping your credit utilization low, and monitoring your credit report regularly. Building a good credit history can open up opportunities for better loan terms and financial options in the future.

Practice Frugality and Smart Spending

Being mindful of your spending habits is crucial for wealth building. Practice frugality by distinguishing between needs and wants, and prioritize spending on essentials while cutting back on unnecessary expenses. Look for ways to save money, such as cooking at home, using public transportation, or shopping for deals and discounts. By adopting a frugal lifestyle, you can free up more resources to save and invest for the future.

Stay Informed and Seek Professional Advice

Stay informed about personal finance topics, market trends, and investment strategies to make well-informed financial decisions. Take advantage of resources such as books, podcasts, online courses, and financial advisors to expand your knowledge and skills. Seek professional advice when needed, especially for complex financial matters like tax planning, estate planning, and retirement savings. A financial advisor can provide personalized guidance and help you navigate the complexities of wealth building effectively.

Embrace the Journey to Wealth

Building wealth as a millennial is a journey that requires patience, discipline, and perseverance. Embrace the process of setting goals, saving, investing, and growing your income over time. Celebrate your milestones and achievements along the way, and stay committed to your long-term financial success. By following these practical tips and staying focused on your wealth-building goals, millennials can pave the way towards a secure and prosperous financial future.